U.S. Online Grocery: Total Sales Continue to Exceed $8 Billion for November 2020

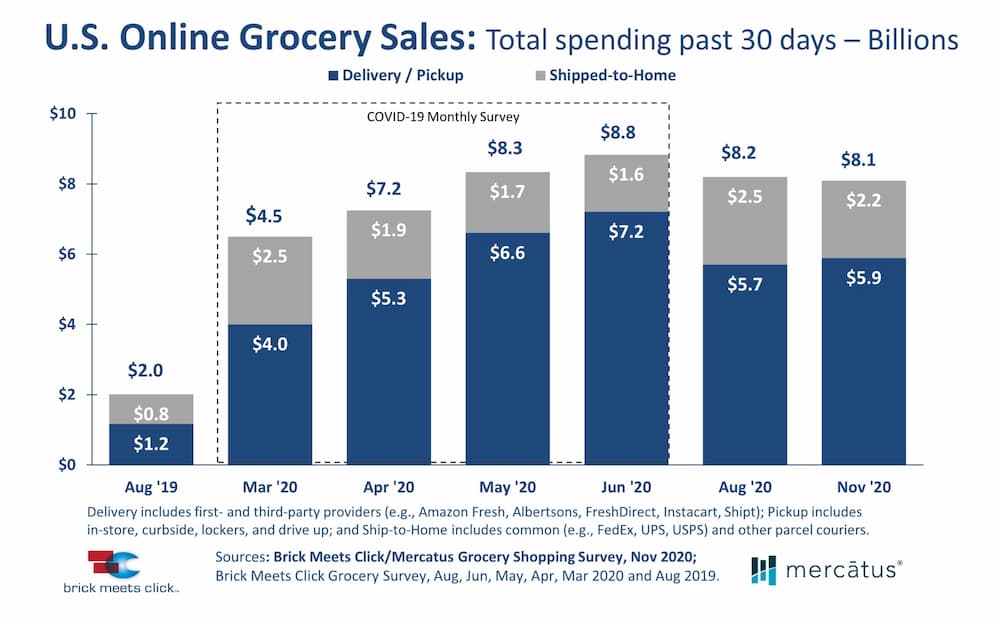

Barrington, IL – Dec. 8, 2020 — The total U.S. online grocery market posted $8.1 billion in sales during November as 60.1 million U.S. households placed on average 2.8 orders during the month, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded Nov. 11-14, 2020. The delivery and pickup segments captured 73% of the online sales during the month and active delivery and pickup shoppers reported a record-high repeat intent rate of 83%.

The continued strong monthly sales trend, which has remained above the $8 billion level since May, combined with a customer mix that reflects a declining share of first-time users, underscores the growing importance for companies to develop, implement, and execute sustainable business building strategies.

For today’s households that buy groceries online, delivery and pickup services play an increasingly essential role in meeting their grocery needs. During November, grocery delivery and pickup services generated sales of $5.9 billion, accounting for 73% of the total $8.1 billion in online spending and capturing 13 more share points compared to August 2019.

“Concerns about contracting the virus, stay-at-home orders, or retail restrictions motivated many to try a service within the last nine months, and now a significant share of those households considers online shopping a desirable alternative to an in-store trip. This presents opportunities as well as threats to established business models and practices,” said David Bishop, partner at Brick Meets Click.

In November, online grocery sales attributed to delivery and pickup services increased 3.6% compared to August 2020. November’s improvement was largely driven by higher order volume, which increased more than 5% from August levels to 62.7 million monthly orders.

The growth in delivery and pickup orders was fueled by increases in the number of households who used delivery or pickup in the past 30 days and by higher order frequency. Comparing November to August 2020, the number of monthly active users grew about 3% to 38.7 million households while the average number of orders that these users placed increased 2% to 1.62 per month.

“It’s evident the U.S. has an expanded base of engaged customers who continue to become more comfortable shopping online for a broader range of grocery products,” Bishop explained. “And, when this happens as quickly as it has this year, it creates a range of challenges for service providers, including building capabilities and competencies, and managing costs and customers.”

One leading indicator, “likelihood to use a specific service again,” recorded a new high score showing customer satisfaction. For November, 83% of the monthly active users of delivery or pick up indicated that they are extremely or very likely to use the most recent service again within the next 30 days, which was up eight points versus August 2020 and up 40 points versus the record low posted in March 2020 when the initial surge in demand degraded the shopping experience.

Although this strong positive score reflects improvements in the overall shopping experience, the research revealed how a declining share of first-time customers – 17% during November, down from 23% in August 2020 – is also helping to increase these scores. The research showed that the probability that a first-time customer will use a service again is 59% as compared to 94% for those who placed four or more orders, so it’s clear that the indicator is being aided by a more experienced mix of shoppers.

“As the online customer mix skews to the more experienced users, retailers will experience headwinds for growth in their delivery and pickup offers. This challenge emphasizes the importance of leveraging tactics designed to boost usage and spending per order with existing customers,” said Bishop.

“Now that we’re months into the pandemic, we’re seeing online grocery shopping becoming engrained among U.S. consumers,” said Sylvain Perrier, president and CEO, Mercatus. “This behavior change shifts the strategic conversation for grocers from acquisition to increasing conversion and retention by driving strong digital engagement. For grocery retailers, the question now becomes how best to provide a differentiated experience that maintains their newly acquired online customers. The answer lies in offering innovative digital solutions and a seamless, rich multi-channel experience.”

About This Consumer Research

Brick Meets Click conducted the survey on November 11-14, 2020, with 2,067 adults, 18 years and older, who participated in the household’s grocery shopping. Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses were weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology in terms of design, timing, and sampling for each of the surveys conducted throughout 2020: August 24-26 (n=1,817), June 24-25 (n=1,781), May 20-22 (n=1,724), April 22-24 (n= 1,651), and March 23-25 (n=1,601).

The 2019 results are based on a similar survey conducted on August 21-23, 2019 with 2,485 adults, 18 years and older.

About Brick Meets Click

Brick Meets Click is a strategic advisory firm that focuses on how digital technology and new competitors are changing food marketing and sales. Founded in 2011, its guidance helps retailers, manufacturers, and suppliers adapt and find new sources of growth by better understanding the shifts in the marketplace and where opportunities exist to grow sales and profits.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce® platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final and others. Mercatus is headquartered in Toronto, Canada.

Media Contacts

David Bishop, Partner

Brick Meets Click

847-722-2732

[email protected]

Greg Earl

Ketner Group Communications (for Mercatus)

512-794-8876

[email protected]

Newsroom

Newsroom